Get the free 553-TN-ARB 914 - badrorgb

Show details

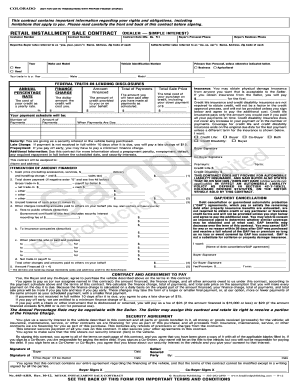

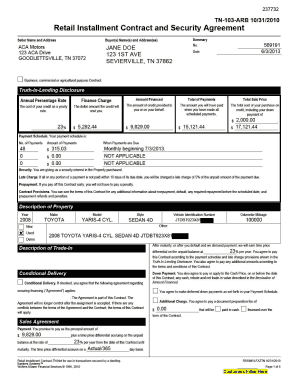

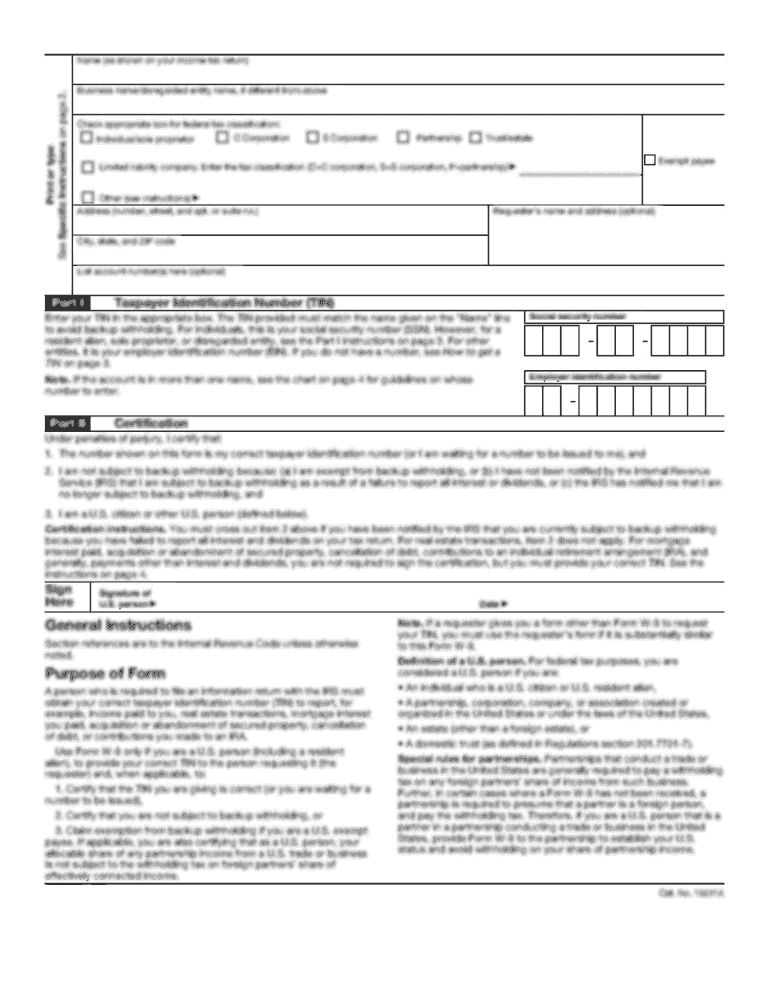

553TNARB0914 FACE 7/2/2014 11:47 AM Page 1 LAW 553TNARB (9/14) R95244 553TNARB0914 553TNARB 9/14 PTG. 7/14 RETAIL INSTALLMENT SALE CONTRACT SIMPLE FINANCE CHARGE (WITH ARBITRATION PROVISION) Dealer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 553-tn-arb 914 - badrorgb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 553-tn-arb 914 - badrorgb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 553-tn-arb 914 - badrorgb online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 553-tn-arb 914 - badrorgb. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out 553-tn-arb 914 - badrorgb

How to Fill out 553-tn-arb 914 - badrorgb:

01

Start by carefully reading the instructions provided on the form. Familiarize yourself with the purpose of the form and the specific information it requires.

02

Begin by entering your personal information in the designated fields. This may include your name, address, contact details, and any other requested information.

03

Move on to the main section of the form where you will provide specific details. This could include information related to a particular case, project, or any other relevant information. Make sure to follow the instructions and provide accurate and complete information.

04

Double-check all the information entered to ensure its accuracy. Mistakes or missing information may lead to delays or rejection of the form.

05

If there are any additional sections or attachments required, make sure to attach them properly as instructed. This may include supporting documents, evidence, or any other necessary paperwork.

06

Review the completed form once again to ensure it is filled out correctly and completely. Any errors or missing information should be addressed before submitting the form.

Who Needs 553-tn-arb 914 - badrorgb?

01

Individuals involved in a legal arbitration process may need to fill out the 553-tn-arb 914 - badrorgb form. This form could be specific to a particular jurisdiction or court.

02

Legal professionals such as lawyers, attorneys, or advocates may require this form to initiate or respond to an arbitration case.

03

Parties involved in a dispute that needs to be resolved through arbitration might need to submit this form. This could include individuals, businesses, organizations, or any other entities seeking an alternative method of dispute resolution.

Note: It is important to consult with the relevant authorities, legal professionals, or resources to confirm the specific requirements and applicability of the 553-tn-arb 914 - badrorgb form in a particular situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 553-tn-arb 914 - badrorgb?

This is not a valid equation.

Who is required to file 553-tn-arb 914 - badrorgb?

Individuals who are required to file Form 553-TN-ARB 914 are Tennessee residents who are subject to the Tennessee individual income tax and who have an amount of taxable income that is greater than their Tennessee income tax liability.

What is the purpose of 553-tn-arb 914 - badrorgb?

553-TN-ARB 914 - BADRORGB is a color code used to identify a specific color palette. It is often used in the design and printing industry to accurately produce a particular color.

What information must be reported on 553-tn-arb 914 - badrorgb?

The 553-tn-arb 914 - badrorgb form is used to report information about the sale, exchange, or other disposition of real estate located in Tennessee. The form must include the following information:

Name and address of the seller

Name and address of the buyer

Purchase price and date of sale

Legal description of the property

Exact location of the property

Property tax ID number

County of sale

Name of the settlement agent

Date of closing

Type of transaction (sale, exchange, etc.)

When is the deadline to file 553-tn-arb 914 - badrorgb in 2023?

The deadline to file 553-tn-arb 914 - badrorgb in 2023 is April 15, 2023.

How do I make edits in 553-tn-arb 914 - badrorgb without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit 553-tn-arb 914 - badrorgb and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for signing my 553-tn-arb 914 - badrorgb in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your 553-tn-arb 914 - badrorgb and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I fill out 553-tn-arb 914 - badrorgb on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your 553-tn-arb 914 - badrorgb by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your 553-tn-arb 914 - badrorgb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.